- Copyright © 2021 | All Rights Reserved |

- Privacy Policy

As a treatment center, you’re probably out-of-network with some payers and don’t know how much you’ll be reimbursed if you treat a client with one of these insurance policies. Not all insurance policies are created equal. At first glance, a policy might look great, but we’ve seen two identical insurance policies pay differently for the same services, and these numbers can vary substantially.

How Treatment Centers Can Make Smart Admission Decisions

June 8, 2021

As a treatment center, you’re probably out-of-network with some payers and don’t know how much you’ll be reimbursed if you treat a client with one of these insurance policies.

Not all insurance policies are created equal. At first glance, a policy might look great, but we’ve seen two identical insurance policies pay differently for the same services, and these numbers can vary substantially.

Why Smart Admission Decisions Are Important

You might operate at a loss for certain clients when you find out too late that their insurance policies pay poorly for your services. Treatment centers spend anywhere from a few weeks to several months treating patients. You’re providing different levels of care that require resources, technologies, and medical expertise that can help your clients reclaim their lives.

So, it’s important to have the right tools in place before accepting new clients. The right tools can help you mitigate the risk of not knowing how much you’ll be paid, which leads to smart admission decisions.

The Solution: Historical Data and the VOB Process

The devil is in the details. You have to gather the right information when calling for VOBs (verification of benefits) and cross-reference the data against historical data on similar policies to find out the reimbursement rates. Your billing team should store all payment data in a database and create a separate database that tracks responses on VOBs. You can then cross-reference the two databases to see which factors in the VOB database are leading to higher and lower payments in the payment database. Once you isolate these factors for each policy type, you can then use that information to predict reimbursement rates on future admissions. The more data you have, the better.

Zealie’s Advantage to Making Smart Admission Decisions

Zealie has billions of dollars of payment data that we cross-reference with hundreds of thousands of VOBs to create our predictive modeling.

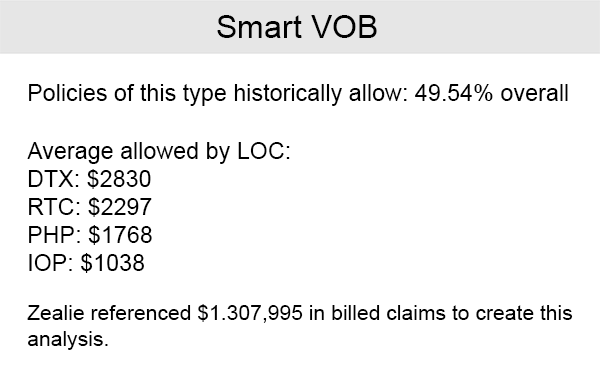

See Example Below:

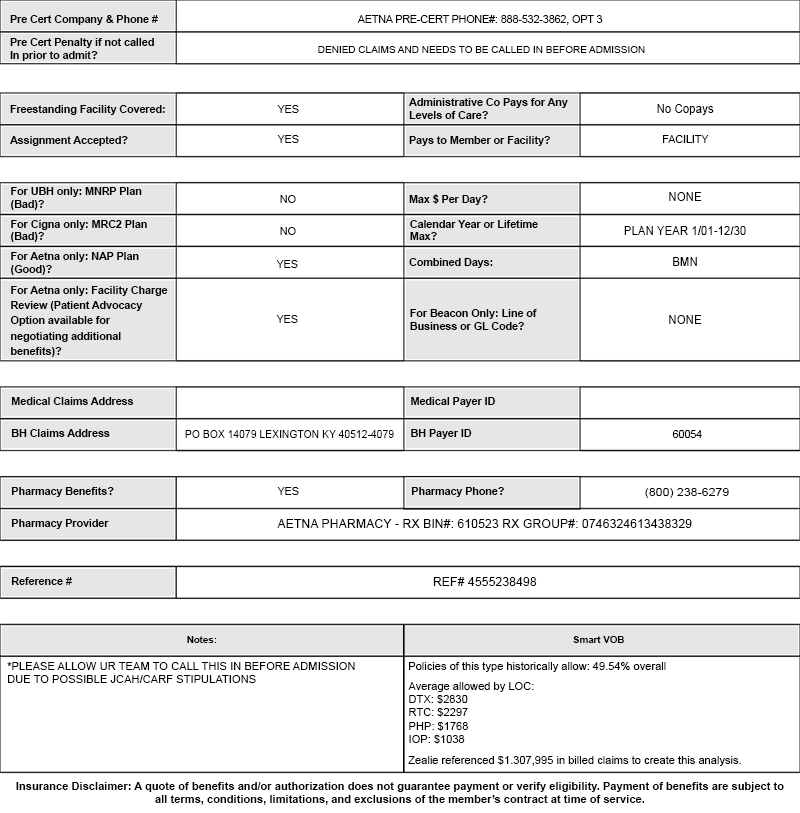

Several policies have patient advocates that have to negotiate rates with healthcare providers to minimize the patient’s portion of the payment. Knowing this information before admission and then cross-referencing that information with other policies from the same payer or third-party administrator, that also had patient advocates, is important.

Once you’re able to see what the insurance companies have historically paid, you’ll know how much you will be reimbursed from the policy that you are admitting.

After running hundreds of thousands of VOBs, and cross-referencing information gathered from those VOBs with billions of dollars worth of claims data, we noticed we could predict payments. The software platform we developed to make these payment predictions is called “Smart VOB.”

Zealie’s Sample VOB Form:

Zealie's Smart VOB

Zealie’s proprietary Smart VOB software estimates how much you’ll get paid before you admit a new client. Smart VOB calculates estimated reimbursement rates for all levels of care, based on billions of dollars of historical data, and presents it to you on your VOB.

Smart VOB is the only software of its kind. Zealie’s software engineers, working hand-in-hand with our billing experts, have created a system like no other. The system reads the responses received when running a manual verification of benefits and isolates the responses that have been determined to have the largest impact on reimbursement rates. Then the system calls Zealie’s vast reimbursement database and locates policies that have the same responses and tells you what those policies have historically paid for the services you provide. All of this happens within seconds of the verification of benefits being completed, giving you the peace of mind of knowing what similar insurance policies have paid for the services you provide.

Many of our clients have been able to sharply increase profits by using our tools to differentiate between policies that adequately reimburse them for their services and those that do not. This gives them that ability to make smarter admissions decisions.